Introduction

Valuation is a critical concept in finance, encompassing the art and science of determining the financial worth of an asset, investment, or business. Whether it’s a publicly traded company, a privately held start-up, a real estate property, or a financial instrument, valuation plays a pivotal role in decision-making processes for investors, businesses, and financial professionals. This article explores the key principles of valuation, common valuation methods, and the importance of accurate and reliable valuations in the world of finance.

The Importance of Valuation

Valuation serves as the cornerstone for various financial decisions, including investment choices, mergers and acquisitions, financial reporting, and strategic planning. A well-conducted valuation provides insights into the intrinsic value of an asset or business, helping investors and businesses make informed decisions and allocate resources effectively. Accurate valuation is vital in ensuring fair market pricing, preventing overvaluation or undervaluation, and maintaining investor confidence and market efficiency.

Key Principles of Valuation

- Market Value vs. Intrinsic Value: Market value refers to the current price of an asset or security in the market, determined by supply and demand forces. In contrast, intrinsic value represents the true underlying worth of an asset, considering its future cash flows, growth prospects, risk factors, and other relevant fundamentals.

- Time Value of Money: Valuation takes into account the time value of money, recognizing that the value of money changes over time due to inflation, interest rates, and opportunity costs.

- Risk and Return: Valuation considers the risk associated with an investment or asset, as higher-risk investments typically demand higher expected returns.

- Diversification: Diversification, or spreading investments across different assets, is taken into account when assessing the overall value and risk of a portfolio.

Common Valuation Methods

- Comparable Company Analysis (CCA): CCA involves comparing the financial metrics and valuation multiples of a company to those of similar companies in the same industry. This method is prevalent in valuing publicly traded companies.

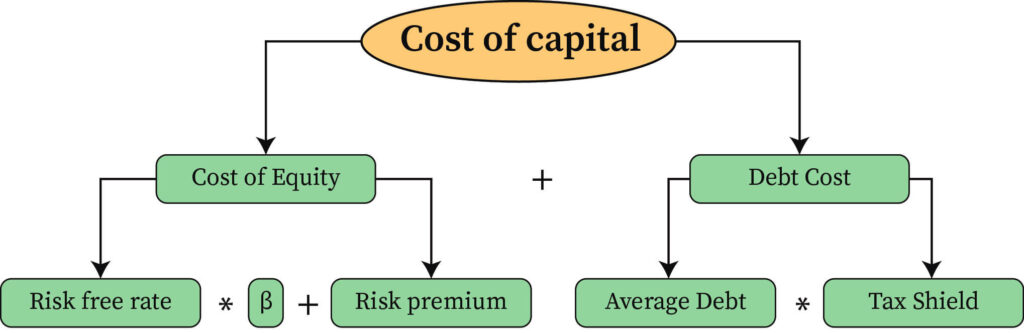

- Discounted Cash Flow (DCF) Analysis: DCF is a widely used method that estimates the present value of future cash flows generated by an investment or business. It involves forecasting future cash flows and discounting them back to their present value using an appropriate discount rate.

- Asset-Based Valuation: This method assesses the value of an asset or business based on the value of its tangible and intangible assets, minus liabilities.

- Precedent Transaction Analysis (PTA): PTA involves comparing the valuation of a company to that of similar companies that were recently acquired in mergers or acquisitions.

The Role of Valuation in Finance

- Investment Decision-Making: Investors use valuation to assess the attractiveness of investment opportunities, determining whether an asset is overvalued, undervalued, or fairly priced.

- Mergers and Acquisitions: Valuation plays a crucial role in determining the price and terms of a merger or acquisition, helping both buyers and sellers negotiate a fair deal.

- Financial Reporting: Companies use valuation to determine the fair value of assets, securities, and goodwill for financial reporting purposes.

- Risk Management: Accurate valuation helps financial institutions assess and manage risk exposure in their investment portfolios.

Conclusion

Valuation is a fundamental concept in finance that guides investment decisions, business transactions, and financial reporting. By understanding the principles of valuation and using appropriate valuation methods, investors, businesses, and financial professionals can make well-informed decisions that align with their financial goals and risk tolerance. Accurate and reliable valuations are essential in maintaining market efficiency, promoting transparency, and fostering investor confidence. As financial markets continue to evolve, the art and science of valuation will remain a critical tool in navigating the complexities of the financial world.